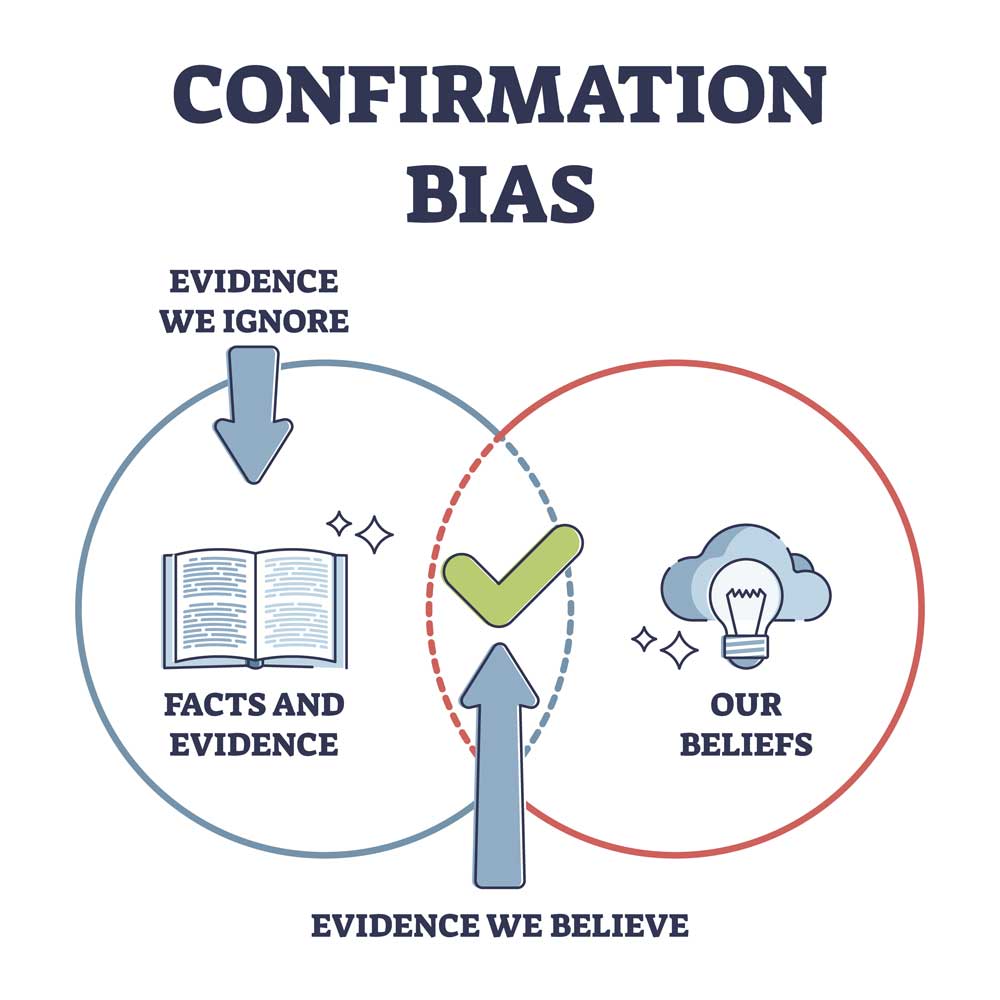

DECISION MAKING BIASES IN PERSONAL FINANCE OBJECTIVES • Reality check. Financial professionals and their clients are both constrained by their decision-making biases. • 3 Behavioral Finance biases affecting counselors and their clients: Confirmation Bias, Overconfidence, and Loss Aversion. • Strategies for mitigating the effects of these specific biases, and cognitive biases in general. Q and A. References for further…