DECISION MAKING BIASES IN PERSONAL FINANCE

OBJECTIVES

• Reality check. Financial professionals and their clients are both constrained by their decision-making biases.

• 3 Behavioral Finance biases affecting counselors and their clients: Confirmation Bias, Overconfidence, and Loss Aversion.

• Strategies for mitigating the effects of these specific biases, and cognitive biases in general.

Q and A.

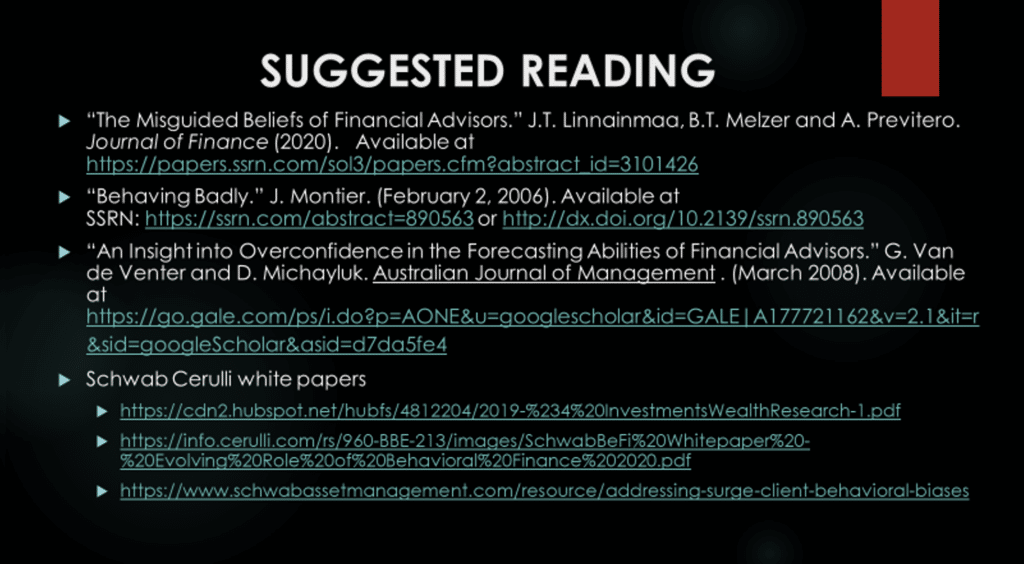

References for further study

“At the Association for Financial Counseling & Planning Education® (AFCPE®) our mission is to ensure the highest level of knowledge, skill, and integrity of the personal finance profession….”

Knowledge, skill, and integrity are affected by behavioral biases, and thus controlling biases is crucial for achieving your mission.

Although many of us may think of ourselves as thinking creatures that feel, biologically we are feeling creatures that think.

– Jill Bolte Taylor

PhD Neuroanatomist who described her own stroke in the award winning and best-selling,

My Stroke of Insight

WE ARE NOT AS RATIONAL AS WE THINK WE ARE

If logic and data were sufficient to solve our problems, there would be no…

• Obese Physicians

• Divorced Marriage Counselors

• Bankrupt Bankers

• Indicted Attorneys

• Tax liens against CPAs

• Debt burdened Financial Advisors

Three Common Behavioral Biases That Negatively Affect Investors’ Returns

• Loss Aversion

• Overconfidence

• Confirmation Bias

These biases also affect financial professionals!

LOSS AVERSION

COMPARE: You have $20,000. You have a choice between a) losing $5000 with certainty vs. b) 50-50 of losing zero or losing $10,000.

Vs.

You have a choice between a) receiving $15,000 with certainty vs. b) 50-50 of receiving $10,000 or receiving $20,000.

• The pain of loss is greater than the joy of an equivalent gain

• We are motivated to avoid a potential regret

• Sunk Costs (Time, Energy, Money, Ego) motivate us to hold on to losses too long (Investments, Relationships, Clients)

How to Deal with Loss Aversion

1. Create guidelines in advance. E.g., Mental stop losses.

2. Look at your portfolio performance less often.

3. Forget what you paid for the stock.

4. Diversify. Follow sound/appropriate rules for asset allocation.

5. Educate/Learn: Financial literacy is vital.

6. Reflect on your own behavior.

OVERCONFIDENCE

The Good News – Bad News about being Smart

Overconfidence Bias applies to IQ and EQ

We all want to feel confident and secure

Clients want their advisors to be Confident…..and that’s the problem!

How to Deal with Overconfidence

1. Increase your self awareness

2. Know what you can and cannot do.

3. Don’t misrepresent your past performance

4. Keep a diary of what you think will happen in the future, and compare your entries to what actually happens

5. Solicit other opinions. ..seek expertise

6. Recognize that luck can determine outcomes, not just your abilities.

CONFIRMATION BIAS

• We seek validation to support what we already believe.

• Investors tend to seek information that confirms their prior views. If they “like” a stock, they will tend to read articles that confirm their bullishness

• Who and What are your sources for financial information? More importantly, Why are they your sources?

How to Deal with Confirmation Bias

1. Broaden your searches

2. Play the devil’s advocate, and encourage it in others

3. Encourage diversity of opinion and encourage others to speak up.

4. Be careful with message boards and chat rooms

5. Exercise diligence and thoroughness.

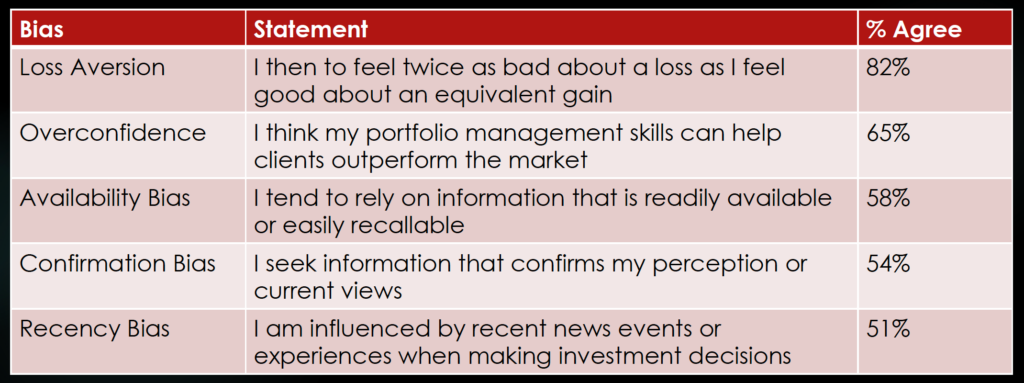

Behavioral Biases of Financial Advisors

STUDIES CONFIRM ADVISOR BIASES

Advisors’ personal portfolios underperform passive benchmarks by the same amount as their clients’ portfolios. Annual risk adjusted alphas are -3.07% for clients and -3.66% for advisors. Financial professionals often display the same biases when dealing with their clients. Many advisors chase returns and overtrade.

– Linnainmaa, Melzer and Previtero, Journal of Finance (2021)

CONTROLLING BIASES

• Know your enemy: That’s you

• Revisit and analyze your history of Good/Bad Decisions

• Diversification works- Broaden your perspective- Seek out DISconfirming information

• If possible, HALT the Decision: Being Hungry, Angry, Lonely, or Tired are emotional triggers

• Confer with others you think are Wise, Sensible, and willing to challenge you; Seek Second opinions

• Establish and follow benchmarks, plans, policies.

• If you have trouble controlling your emotions, seek therapy.

Feel free to use and share this PPT deck, or portions of it, in your coaching and educational sessions.