Confirmation Bias is the third article in our trilogy of behavioral finance biases affecting financial advisors and their clients. Indeed… that is one of the reasons Smart People Do Stupid Things… Feel free to download copies for yourself, your colleagues and your clients.

CONFIRMATION BIAS

A BEHAVIORAL FINANCE BIAS AFFECTING ADVISORS AND THEIR CLIENTS

David Dubofsky, PhD, CFA

Lyle Sussman, PhD

Here’s a common prescription offered by both executive coaches and life coaches – sharpen your focus. Know what you want to accomplish, set priorities, and concentrate on what needs to be done to achieve your goal. Although that advice is intuitively logical and useful, there is a dark side of focus, an unintended consequence of narrowly concentrating your attention and limiting your perspective.

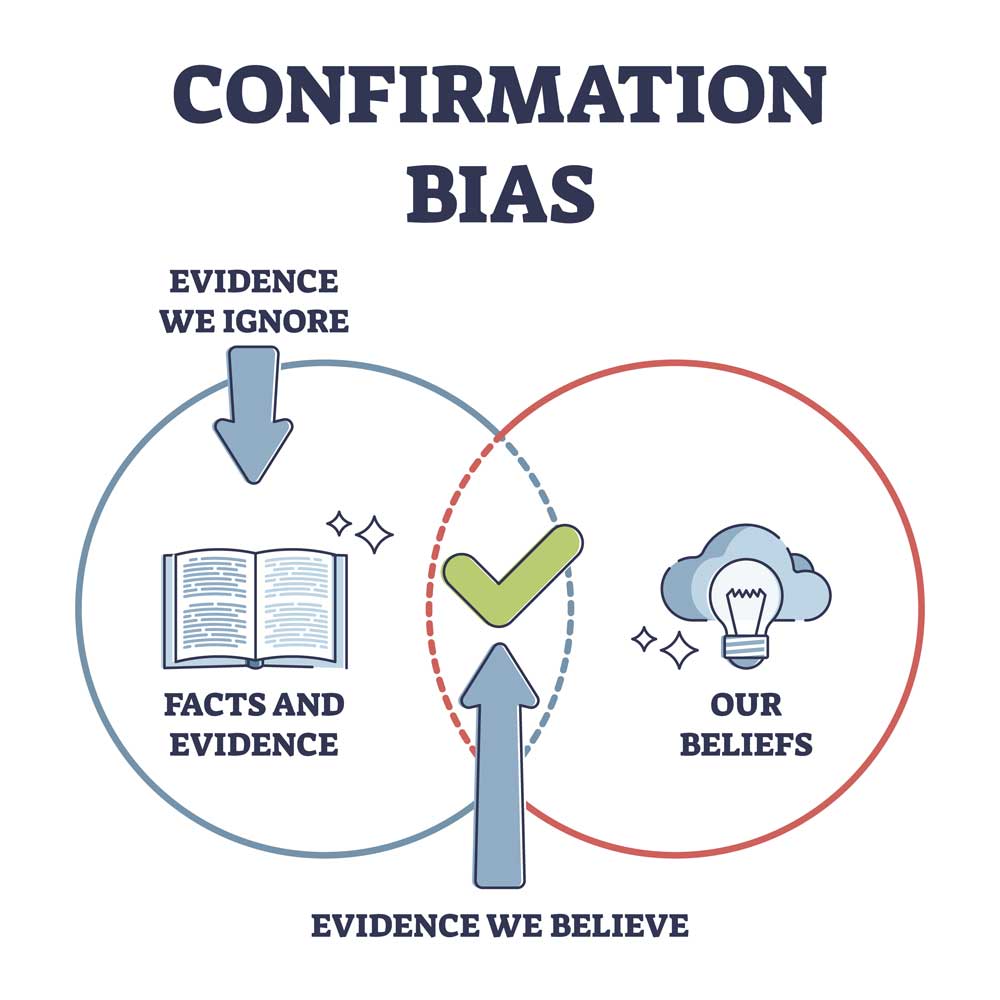

By intently and exclusively focusing on X, we necessarily disregard anything that is not X. The unintended consequence of this selective perception, when applied to financial planning, results in confirmation bias, a decision-making bias with potentially devastating consequences.

Confirmation Bias Defined

Confirmation bias refers to the tendency to read, watch, communicate and seek information that agrees with one’s prior beliefs. In short, we bias our search options by focusing on information confirming our existing opinions. Those afflicted by the bias avoid information contrary to what they already believe, and discount contrary information when forced to consider it. The bias also confers greater credibility on those sources of information confirming our beliefs. In essence confirmation bias is a myopic view of the world, and your role in it.

Many experts believe that seeking support for our beliefs is just human nature. Most of us are prone to confirmation bias in one way or the other. After all, every day we are inundated with messages, and must choose what is and isn’t important for our survival. Without that choice we would suffer the stress of information overload. Thus, confirmation bias is both a conscious and subconscious, automatic, response to a complicated world …. a world where we must differentiate signal from noise, albeit a preconceived notion of signal.

Because of our need to simplify and focus, confirmation bias and its effects exist across multiple arenas. Moreover, the rise of social media has strengthened our tendency to fall prey to confirmation bias and given rise to conspiracy theories, fake news and other misinformation that supports prior views. For example, the bias exists within our judicial system, leading to wrongful convictions and acquittals. In the political arena, many conservative Republicans tend to watch Fox News and read the Wall Street Journal. Many liberal Democrats only watch CNN and read the New York Times.

Investors and Confirmation Bias

When it comes to financial markets and the economy, investors prone to confirmation bias will read only bullish stock reports about stocks that they own or are seriously thinking of buying. They won’t read bearish opinions. If they believe the economy is strong, they will read and listen to others who also believe the economy is strong. They discount or ignore contrary opinions.

The finance-related problem with confirmation bias is twofold: 1) You will block out information that challenges your views, and 2) You will seek out information supporting your views. You will develop a closed mind that doesn’t entertain the possibility of being wrong. In this sense, confirmation bias contributes to overconfidence that your investment decisions are correct. Note that there is a closed loop relationship between confirmation bias and overconfidence: the latter also increases the risk of the former and vice versa.

Advisors and Confirmation Bias

Financial advisors are also prone to confirmation bias. The Schwab-Cerulli (2019) survey found that 54% of financial advisors agreed that they “… seek information that confirms my perception or current views.” Time is a precious resource for financial advisors. Because of this, many just don’t have the time to study all sides of an opinion. In addition, because of competing pressures many financial advisors must limit their time studying alternative arguments that are contrary to their existing beliefs; see Nekrasov, Teoh and Wu (2022).

Affiliation with a major financial services enterprise may exacerbate an advisor’s confirmation bias. We should not be surprised by advisors supporting the products and strategies of the organization that they are affiliated with. Moreover, some employers may contractually require their advisors to sell their products and services, rather than comparable products and services from a competitor.

Financial Consequences of Confirmation Bias

Confirmation bias will affect portfolio performance in the following ways:

- Creates herding behavior and market overreactions. It reinforces momentum in stock returns, leading to bubbles.

- Encourages chasing returns. Investors will likely read reports that explain why a winning stock will continue to rise.

- Leads to overconfidence. The more that investors and advisors and hear the same opinions that confirm their prior beliefs, the more confident they will be that their beliefs are correct.

- Reinforces “recency bias.” This is the tendency to put too much weight on the recent past and to underweight longer run history. The 2021 Schwab and Cerulli survey found that advisors believe that recency bias and confirmation bias are the two most commonly observed behavioral biases of their clients.

- Leads investors to jump on bandwagons of investment trends. We believe that crypto fans and sceptics are particularly prone to confirmation bias. Crypto belief, pro or con, is like a religious belief.

Remedying Confirmation Bias

To control confirmation bias, reset your focus and attention. Open yourself up to other opinions. Only then can you conclude that your opinions are better. You will have considered the other side. If you don’t consider all perspectives and viewpoints, it is unlikely you will be a successful investor or advisor. Find a devil’s advocate or assume that important role yourself. Consider the following suggestions:

- Increase your diligence.

- Broaden your search options: media, contacts, networks.

- Encourage others around you to become devil’s advocates. Hire devil’s advocates if necessary.

- Encourage others to speak up and offer diversity of opinion.

- Always consider the risks when making any decision or offering any recommendation. Disclose these risks.

- Confer with others you think are wise, sensible, and willing to challenge you.

- Avoid message boards and chat rooms where stock recommendations and ideas similar to your own are hyped.

- Read and consider Standard V of the CFA Institute Standard of Practice Handbook (2014). It requires CFA Members and Candidates to exercise diligence and thoroughness when making investment recommendations and/or actions. This is a practice all financial advisors should follow. This standard will curb confirmation bias. Advisors must make reasonable efforts to “cover all pertinent issues” when making decisions and recommendations. Being thorough requires that analysts overcome their confirmation bias.

- Financial advisors can help their clients overcome confirmation bias by effective communication, listening to and understanding their clients, and tactfully providing alternative views.

Conclusion

Of course focus is important. Without it our lives would be a frenetic and chaotic disaster. But when that focus is biased rather than objective, we necessarily suffer unintended consequences. Financial planners and their clients must be constantly aware of their self-serving need to affirm their intelligence and their wisdom. They must seek disconfirming information and view it as potentially valuable Failure to do so could result in financial decisions with life altering regrets.

REFERENCES

CFA Institute, Standards of Practice Handbook, 11th edition, 2014. Available at https://www.cfainstitute.org/-/media/documents/code/code-ethics-standards/standards-practice-handbook-11th-ed-eff-July-2014-corr-sept-2014.pdf

Nekrasov, Alexander, Siew Hong Teoh, and Shijia Wu, “Limited Attention” (June 30, 2022). Handbook of Financial Decision Making, Forthcoming, Available at SSRN: https://ssrn.com/abstract=4128057

Schwab and Cerulli, “Mitigating the Impact of Advisors’ Behavioral Biases,” 2019. Available at https://investmentsandwealth.org/getmedia/dea8bde8-2399-4534-b97f-541dd7e46123/Cerulli-whitepaper-Mitigating-the-Impact-of-Advisors-Behavioral-Biases-002.pdf .

Schwab and Cerulli, “Addressing a Surge in Client Behavioral Biases,” 2021. Available at https://www.schwabassetmanagement.com/resource/addressing-surge-client-behavioral-biases .

David Dubofsky and Lyle Sussman are co-authors of Your Total Wealth: The Heart and Soul of Financial Literacy (HSF Publishing, 2021). See: www.YourTotalWealth.com

Copyright © by HSF Publishing LLC, Dover, Delaware. All rights reserved.