We wrote that perhaps the primary advantage of investing in index funds and index ETFs is their low expenses. But there are some index funds that charge outrageously (in our opinion) high expense ratios. We don’t understand why any investor would ever invest in them. If it is because their financial advisor put them there, they need a different financial advisor. If it was their own decision, they need a financial advisor.

For example, there is a large S&P500 index fund that has a very low expense ratio of 0.015%. An expense ratio of 0.015% means you should expect to underperform the S&P500 index by 0.015% each year. Thus, if the rate of return on the S&P500 index is 13.99% (which was the actual rate of return on the S&P500 in the ten years ending June 30, 2020), you might expect to get a rate of return of 13.975% on this low expense ratio S&P500 Index Fund. It turns out that during that decade, you would have earned 13.97% in this fund!

But other S&P500 index funds have higher expense ratios. Some are very high. There is actually one with an expense ratio of 2.41%! In the ten years ending June 30, 2020, the S&P500 index returned 13.99% per year, while this particular S&P500 index fund returned only 11.22% per year!

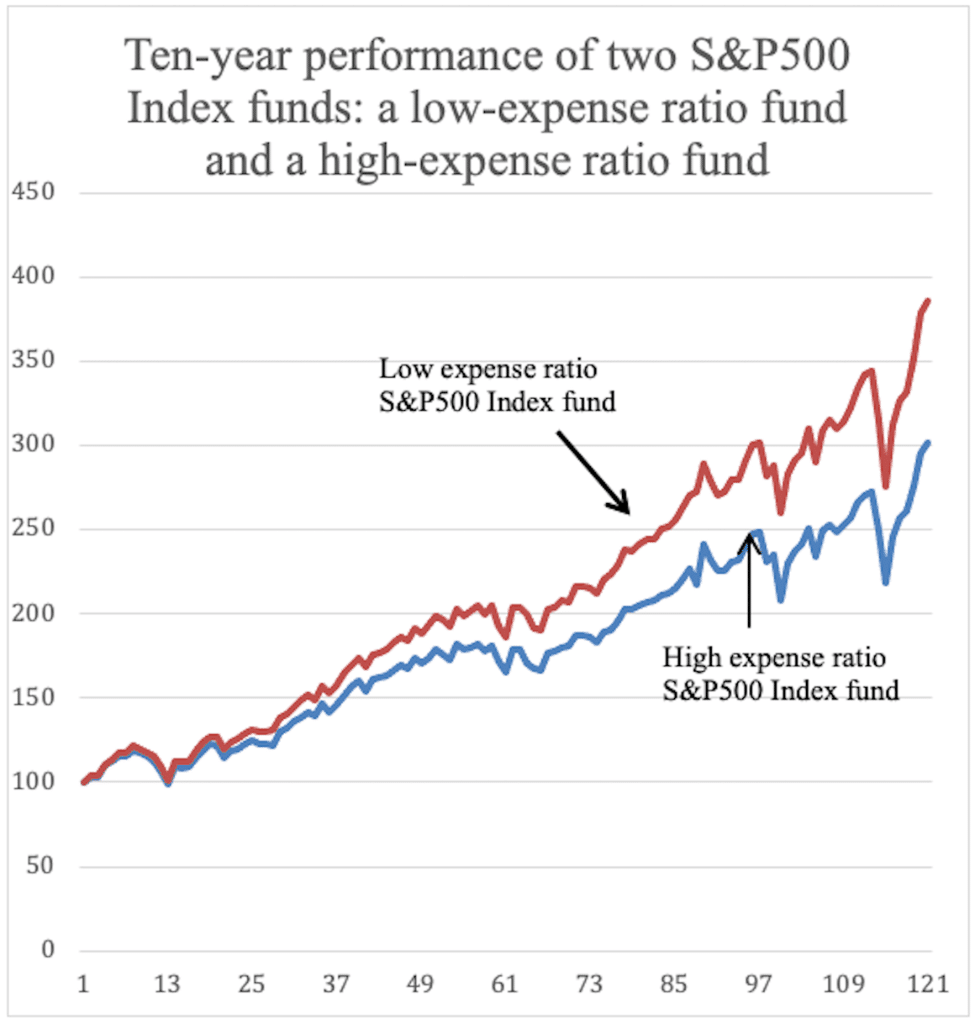

The graph below shows how $100 invested in two different S&P500 index funds on June 1, 2010 would have fared over the ten-year period (121 months) ending August 31, 2020. You would have ended up with $386 in the low expense ratio index fund, but only $302 in the S&P500 index fund with a 2.41% expense ratio. Let us stress again…. both funds hold exactly the same portfolios.

Leveraged index funds (2X and 3X funds, and inverse funds) have peculiarities that you must understand before using them. So much so that the SEC issued a special warning about them; see sec.gov/investor/pubs/leveragedetfs-alert.htm.